- Why Choose Exness?

- Key Features of Exness for Mauritanian Traders

- Exness Platforms for Mauritanian Traders

- Account Types for Mauritanian Traders

- Islamic Trading with Exness

- Equity Spreads, Leverage, Commissions, and Fees

- Exness Social Trading

- Is Exness Legal in Mauritania?

- Educational Resources for Mauritanian Traders

- FAQ

Why Choose Exness?

When you start trading, selecting the correct broker is essential for your success in the world of trading. Exness Mauritania is a flagship firm among these several factors that valve the service provider with a nice regard and urge for food for those merchants particularly from Mauritania. Exness, at first very point, provides instant withdrawals which enable traders to have their money in an intrusive way.

This is a revolutionary development in terms of liquidity for those investors who cannot afford to keep their capital locked up for an extended period. This means that, although you will have to pay a high commission on the two aforementioned accounts, spreads are competitive and leverage is unlimited with Exness Mauritania as well.

Secondly, You can start trading here without a huge investment. This is the best option for small traders and large traders. In addition to that, Exness platforms are famous for their lightning fast execution. You can trade with minimal slippage round the clock, regardless of whether you trade during peak market times or off-peak hours and execute your trades at the best prices available.

Key Features of Exness for Mauritanian Traders

Exness provides several attractive features for traders in Mauritania, making it a preferred choice for many. Here are the key features:

- Instant withdrawals: Access your funds quickly, without delays, ensuring efficient capital management.

- Competitive spreads: Low trading costs, allowing traders to maximize their profits.

- Unlimited leverage: Control larger positions with a smaller investment, offering more flexibility in trading strategies.

- Wide range of trading instruments: Access to forex, metals, cryptocurrencies, and more, allowing for a diversified portfolio.

- No hidden commissions: Transparent fee structure, so you know exactly what you’re paying.

- High security and compliance: A safe and reliable trading environment, with a strong focus on protecting trader funds.

Exness Platforms for Mauritanian Traders

Exness provides Mauritania traders with a few excellent trading platforms. In terms of design, each platform has been developed to be intuitive and is now armed with a suite of robust new trading instruments. Whether you trade on your desktop, laptop or mobile device, Exness offers choices to match wherever you are.

MetaTrader 4

MetaTrader 4 (MT4) is an internationally renowned classic platform used by millions of market participants. This platform is filled with sophisticated features tailored to meet the demand of Mauritanian traders, which include advanced charting tools, numerous order types and the possibility of automated trading using expert advisors (EAs). Therefore, this is great for manual and for algorithmic trading.

MT4 offers an array of financial markets for trading, you can analyze price movements with the help of 30 inbuilt technical indicators and other useful tools, run Expert Advisors (automated strategies), use hedging facilities and utilize precision accuracy in orders. The stability and speed of the platform ensures you all opportunities.

MetaTrader 5

MetaTrader 5 (MT5) is the upgraded version of MT4, offering even more advanced features. It supports more timeframes, additional order types, and an improved user interface. Mauritanian traders who want access to a broader range of trading instruments, including stocks and futures, may prefer MT5.

MT5 also provides enhanced analytical tools and faster execution speeds, making it suitable for traders who need more detailed market analysis. The platform also allows for multi-asset trading, giving traders access to a wider selection of financial markets.

Exness Web Terminal

Exness Web Terminal is a web-based trading platform that allows you to trade as conveniently, without downloading software. Ideal for traders in Mauritania, those who wish to open their accounts quickly from any device connected to the Internet. Trade forex, metals over any web browser, using our new Exness Web Terminal.

The interface is intuitive and it supports real-time charting, multiple order types, as well as one-click trading to ensure a smooth trading experience. It’s ideal for traders who prefer to keep things simple and flexible.

Exness Trade App

It is the ideal solution for Exness Mauritania-based traders who are always on the go. Similar to this, a mobile app is also there for iOS and Android to make your trading better on the go. You have access to your smartphone where it is possible to carry out operations in the market and directly manage your account.

One such app is the Exness Trade App, which includes notifications for real-time prices, customizable charts and one-click deposits/withdrawals. That is ideal for those investors who want to be on top of it and need to respond rapidly when the market moves from wherever they are.

Account Types for Mauritanian Traders

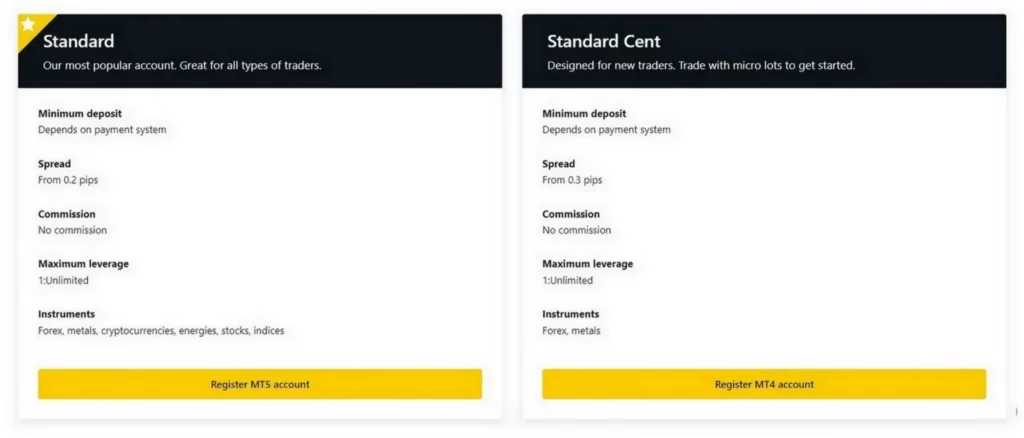

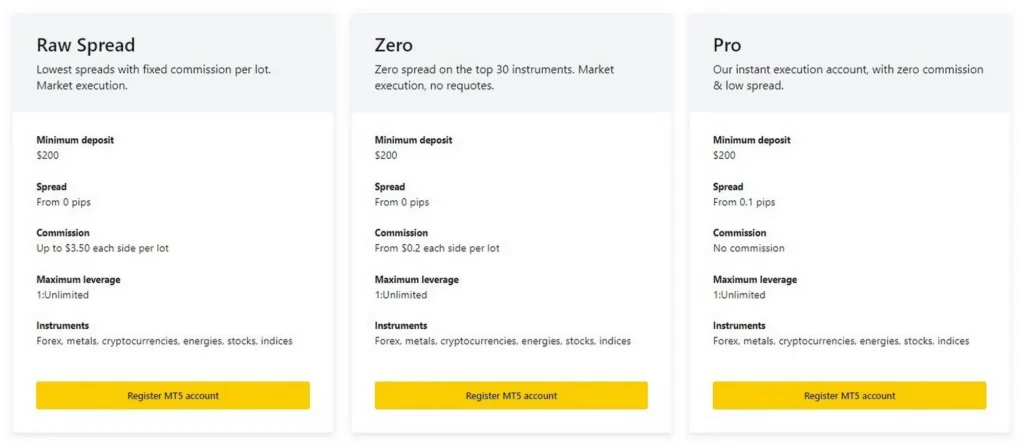

Exness offers several account types to cater to different trading styles and experience levels for Mauritanian traders. Whether you’re a beginner or an experienced trader, you’ll find an account that fits your needs. Here’s a quick overview:

- Standard Account: Ideal for beginners, this account offers low minimum deposits, competitive spreads, and no commissions on trades. It’s user-friendly, making it a great option for those just starting in forex trading.

- Standard Cent Account: This account is ideal for beginner traders who want to trade smaller positions with less risk. It allows for trading with cent lots, giving you more control over your trades while minimizing risk.

- Pro Account: Designed for more experienced traders, the Pro account offers tight spreads, faster execution, and more trading instruments. It’s perfect for traders who require more advanced tools and strategies.

- Raw Spread Account: For traders seeking the lowest possible spreads, this account offers spreads starting from 0 pips with a fixed commission per trade. It’s best for those who value precise trading and cost transparency.

- Zero Account: Offers zero spreads on key currency pairs, making it a great option for traders who prefer consistent, predictable costs.

Islamic Trading with Exness

For traders in Mauritania who follow Islamic principles, Exness provides swap-free or Islamic accounts. These accounts are fully compliant with Sharia law, meaning they do not charge or pay interest on overnight positions, which is known as a swap.

Key features of Islamic trading with Exness Mauritania include:

- No interest or swaps: Positions held overnight do not incur any interest fees, making it compliant with Islamic finance principles.

- Access to all trading instruments: Islamic accounts can still trade forex, metals, cryptocurrencies, and more, without limitations.

- Available for all account types: Whether you choose a Standard, Pro, Raw Spread, or Zero account, you can opt for the Islamic account feature.

- No extra costs: Traders don’t face additional hidden fees for using an Islamic account, ensuring fairness and transparency.

Equity Spreads, Leverage, Commissions, and Fees

Exness provides Mauritanian traders with competitive trading conditions, which makes it easier to manage costs and maximize profits. Here’s a breakdown of key aspects:

- Spreads: Exness offers some of the lowest spreads in the market, starting from as low as 0 pips on certain accounts. The spreads depend on the account type you choose, with tighter spreads available on the Raw Spread and Zero accounts.

- Leverage: One of Exness’ most attractive features is its unlimited leverage. This gives traders the ability to control large positions with a small amount of capital. However, leverage should be used wisely as it can amplify both gains and losses.

- Commissions: For most accounts, Exness does not charge commissions on trades. However, the Raw Spread and Zero accounts charge a fixed commission per lot, which is clearly stated upfront to ensure transparency. Commissions for these accounts are competitive, making them suitable for high-volume traders.

- Fees: Exness Mauritania prides itself on having no hidden fees. There are no fees for deposits and withdrawals, and the broker covers most payment system commissions. Additionally, with Islamic accounts, traders can avoid overnight swap fees.

These features provide a cost-effective trading environment that allows Exness Mauritanian traders to focus more on strategy and less on expenses.

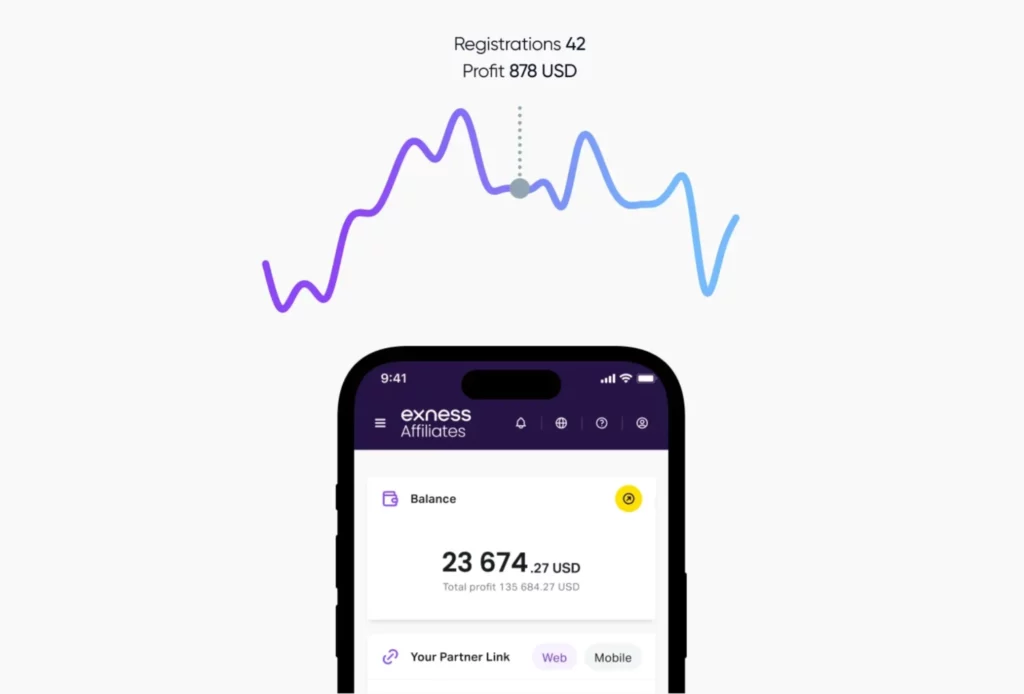

Exness Social Trading

With Exness Social Trading, traders from Mauritania can copy the strategies of experienced traders such as this. You do not have to get into the details. You are able to copy the traders directly into your account by social trading. This makes it great if you’re a beginner or would rather learn by observing. The process is simple.

You can also see how well various traders have performed in the past and choose to follow them. After you selection, their trades are automatically copied to your account. You can also stop or adjust the copying at any time. It’s a flexible way to learn from others while potentially making profits.

Is Exness Legal in Mauritania?

Yes, Exness is legal and fully operational in Mauritania. Exness operates in several regions worldwide and complies with international regulations and standards. While Exness Mauritania does not have a specific financial regulatory body overseeing forex brokers, Exness is regulated by various well-known authorities globally, ensuring it adheres to strict legal and financial practices.

Exness Mauritania operates under licenses from top regulatory bodies like:

- Cyprus Securities and Exchange Commission (CySEC): Ensures that the broker follows European Union financial regulations.

- Financial Conduct Authority (FCA) in the UK: Guarantees compliance with UK standards.

- Seychelles Financial Services Authority (FSA): Regulates its operations for non-European clients.

This means traders in Exness Mauritania can confidently use Exness, knowing that it operates under international financial laws and provides a secure trading environment.

Educational Resources for Mauritanian Traders

Exness offers a variety of educational resources that help traders in Mauritania improve their skills. Whether you’re new to trading or have some experience, you’ll find helpful tools to guide you. For beginners, there are simple tutorials that explain how to use the platform, how to place trades, and how to manage risks. These guides make learning easy and straightforward.

For more experienced traders, Exness Mauritania provides webinars and live sessions where professionals share tips, strategies, and market insights. You can also practice with a demo account, which allows you to trade without using real money. This way, you can test your strategies and get comfortable with the platform before trading live.

Additionally, Exness keeps traders informed with daily market news and analysis. This helps you stay updated on market trends and make more informed decisions. With these resources, Mauritanian traders have everything they need to grow and succeed.

FAQ

Is Exness legally authorized to operate in Mauritania?

Yes, Exness is legally authorized to operate in Mauritania. While the country doesn’t have a specific regulatory body for forex, Exness is licensed by global regulators like CySEC, FCA, and FSA, ensuring a secure and compliant trading environment.