What is Exness?

Exness Qatar is an international broker that allows trading differently on the world financial markets. A band of finance and technology professionals gathered at Exness since its onset, gradually forming something that would ultimately achieve global presence as a respected broker. Demo trading is available as well across all types of accounts, and there are also corporate accounts for institutional clients.

One of the notable things about Exness is that it scores high in security and regulation. Clients’ funds are kept in segregated bank accounts and the broker is authorized by a financial regulator, which means that trading conditions at this brokerage house should be very fair. Account types for traders at Exness Qatar cater to both beginners and more experienced traders. Inclusive of this, the broker offers Islamic (swap-free) accounts to suit Muslim traders faith based financial principles.

Exness has been gaining in popularity and it is not just because of the sheer number a tradable instruments on offer; but due its focus over paramount security as well as providing an easy, hassle-free trading experience.

Why Choose Exness for Trading in Qatar?

Traders in Qatar choose Exness for several key reasons:

- Exness Regulation and Security : This broker is supervised under several financial authorities which acts as a security principal of commodities trading.

- Various Financial Instruments: Access to a diverse selection of financial instruments, including forex, commodities, and cryptocurrencies.

- Competitive Pricing: Keep trading costs low with tight spreads all helping to make you the most from your trades.

- Execute Fast and Withdraw Instantly: Experience high-speed trade execution & instant withdrawal of your funds without any delay.

- QAR Deposit and Withdrawal: Custom-catered local payment methods for Qatari traders.

- Arabic-support: Customer service is available in Arabic for easy communication and aid.

Account Types Available for Qatari Traders

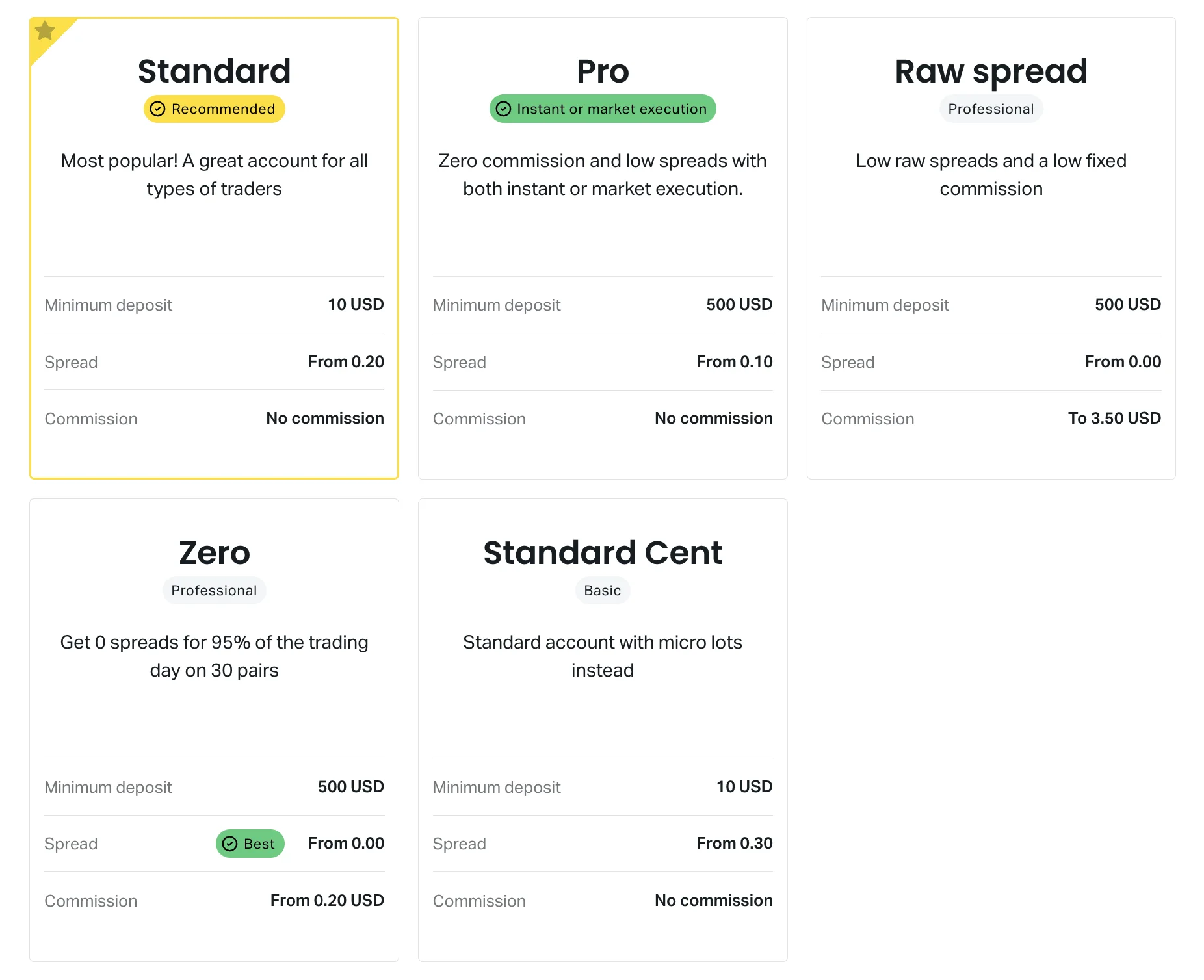

Exness Qatar provides a variety of account types to suit different trading styles and experience levels, making it a flexible option for traders in Qatar. Here’s a breakdown of the account options available:

The Standard Account at Exness is a popular choice, suitable for both beginners and experienced traders. It features no commission fees on trades, competitive spreads, and does not require a minimum deposit, making it accessible to a wide range of traders.

The Pro Account is designed for those with more experience, providing tighter spreads and faster trade execution. This account is ideal for traders who operate with larger volumes and demand more precision and efficiency in their trading activities.

The Raw Spread Account appeals to traders who are focused on minimizing trading costs. This account offers raw spreads with a small, fixed commission per trade, allowing traders to benefit from some of the lowest spreads available.

The Zero Account is perfect for traders who focus on major currency pairs, offering zero spreads on these pairs for the first trade of the day. It is an excellent choice for those who prioritize cost efficiency in their trading strategy.

The Islamic Account is essential for Muslim traders, as it is swap-free, ensuring that no interest is charged on overnight positions. This account type fully complies with Islamic finance principles, making it suitable for traders who need to adhere to Sharia law while engaging in trading activities.

Each account type is designed to meet the needs of different traders, from beginners to seasoned professionals. Whether you’re looking for low-cost trading or advanced features, Exness Qatar has an account that fits your trading style.

Exness Sign Up Process

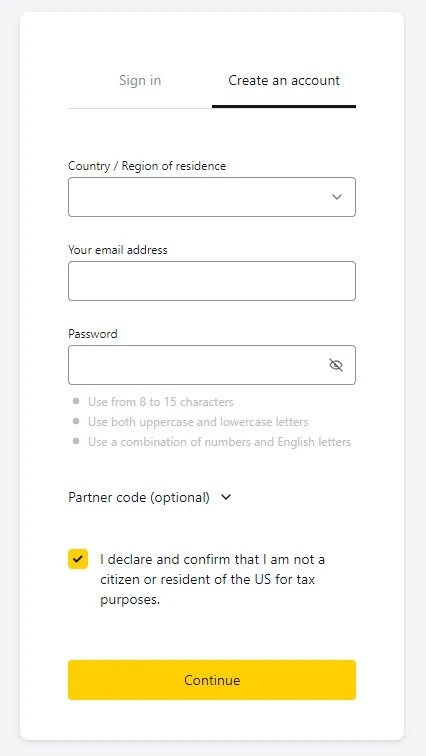

Signing up with Exness Qatar is simple and can be done in just a few steps. Here’s how you can get started:

- Visit the Exness Website: Start by going to the official Exness site, where you’ll see an option to create a new account on the homepage.

- Enter Your Details: Click on the sign-up button and fill in the registration form. You’ll need to provide your name, email address, and phone number. It’s important to use accurate details, as this information will be needed later for account verification.

- Select Your Account Type: After registering your details, choose the type of trading account that suits your needs. Exness offers several options, including Standard, Pro, Raw Spread, Zero, and Islamic accounts. Each account type caters to different trading preferences, so select the one that aligns with your goals.

- Create Your Login Credentials: Set up a secure password for your account. A strong password is crucial for keeping your account safe.

- Verify Your Identity: To comply with regulatory requirements, you’ll need to verify your identity and address. This involves uploading a valid ID (like a passport or national ID card) and a proof of address (such as a utility bill or bank statement). This step helps ensure that your account is secure and that you are who you say you are.

- Make Your First Deposit: Once your account is verified, you can deposit funds. Exness supports various payment methods, including bank transfers and credit/debit cards, which makes it easy for traders in Exness Qatar to add funds to their accounts.

- Start Trading: With your account funded, you’re ready to trade. Download the trading platform that suits you best, whether it’s MetaTrader 4, MetaTrader 5, or the Exness Web Terminal, and begin exploring the markets.

The sign-up process is straightforward, allowing you to focus on trading once your account is set up.

Navigating the Exness Login

Logging into your Exness Qatar account is a simple process, whether you’re using a computer, smartphone, or web terminal. Here’s how to do it:

- Visit the Exness Website: Start by heading to the official Exness website. Look for the login button in the top right corner of the homepage and click on it.

- Enter Your Login Details: On the login page, enter the email address and password you used when you registered. Be sure to type in the correct details to avoid any login issues.

- Access Your Trading Platform: After logging in, you’ll be taken to your Personal Area, where you can choose the trading platform you want to use. Whether it’s MetaTrader 4, MetaTrader 5, or the Exness Web Terminal, you can easily access it from here using the same login credentials.

- Logging in on Mobile: For those who prefer trading on their mobile devices, download the Exness app from the App Store or Google Play. Open the app, enter your login details, and you’ll be ready to manage your trades on the go.

- Enhanced Security with 2FA: If you want extra security, you can enable two-factor authentication (2FA). This means you’ll need to enter a code sent to your phone or email every time you log in, adding an extra layer of protection.

- If You Forget Your Password: In case you can’t remember your password, click on the “Forgot Password?” link on the login page. Follow the steps to reset your password. If you run into any other issues, customer support is available to help.

Logging in to your Exness Qatar account is straightforward, allowing you to manage your trades and account settings from any device. Once you’re logged in, you’re ready to start trading.

Exness Trading Platforms

Exness provides several trading platforms to meet different trading needs. Whether you prefer to trade on a computer, through a web browser, or on your phone, there’s an option for you. Here’s a look at the platforms you can use with Exness.

Exness Web Terminal

The Exness Web Terminal is easy to use. You don’t need to download anything, just log in through your web browser and start trading. It’s simple and quick, perfect for traders who want to access their accounts from any device with an internet connection. You can monitor the markets, place trades, and manage your account all from your browser. It’s a convenient option, especially if you need to trade while you’re away from your usual setup.

Exness MT4

MetaTrader 4, or MT4, is a popular trading platform. It’s well-known for its reliability and the tools it offers. MT4 is a great choice for both beginners and experienced traders. It provides everything you need to analyze the markets, automate your trades, and customize your trading setup. Whether you’re trading currencies, commodities, or indices, MT4 has you covered. It’s a solid platform that has stood the test of time, making it a favorite among traders.

Exness MT5

MetaTrader 5, or MT5, is the next step up from MT4. It offers more features and is built for traders who want more advanced tools. MT5 includes additional timeframes, more order types, and an economic calendar right in the platform. If you’re looking to expand your trading and use more sophisticated tools, MT5 might be the right choice. It’s designed for those who want to dive deeper into market analysis and trading strategies.

Exness App

The Exness App is for traders who like to trade on the go. It’s available for both iOS and Android devices. The app lets you trade from your phone or tablet, so you can manage your account, check live prices, and place trades no matter where you are. The app is straightforward and easy to use, making it a great option if you need to stay connected to the markets while you’re on the move.

| Feature | Exness Web Terminal | Exness MT4 | Exness MT5 | Exness App |

|---|---|---|---|---|

| Installation | None (Web-based) | Download required | Download required | Download required (iOS/Android) |

| Timeframes | 9 | 9 | 21 | 9 |

| Order Types | 4 | 4 | 6 | 4 |

| Automated Trading | No | Yes | Yes | No |

| Indicators | 30+ | 30+ | 38+ | 30+ |

| Devices Supported | Any (Web browser) | PC, Mac | PC, Mac | iOS, Android |

Features for Qatari Traders

Exness Qatar offers a range of features that cater specifically to traders. These features are designed to enhance the trading experience, whether you’re just starting out or have years of experience in the markets. Here’s a look at some of the key features available.

Social Trading Options

Social trading is a great way for traders in Exness Qatar to learn from others and potentially improve their trading strategies. With Exness, you can follow and copy the trades of more experienced traders, making it easier to start trading even if you’re new to the market. This feature allows you to see what successful traders are doing and replicate their trades in your own account. It’s an ideal option for those who want to learn by example and engage with the trading community.

Demo Accounts for Practice

To those who are new to trading or want to try out their strategies without any real money, Exness provides demo accounts. These accounts will enable you to trade in actual market situations with digital cash consent. Therefore it is a safe way to get practicing and begin getting familiar with the trading platforms, available tools etc. Experiment with trading styles, learn how to trade on the platforms and try your hand at different systems before continuing onto Live accounts. This is a good feature for beginners and experienced traders looking to improve their skills.

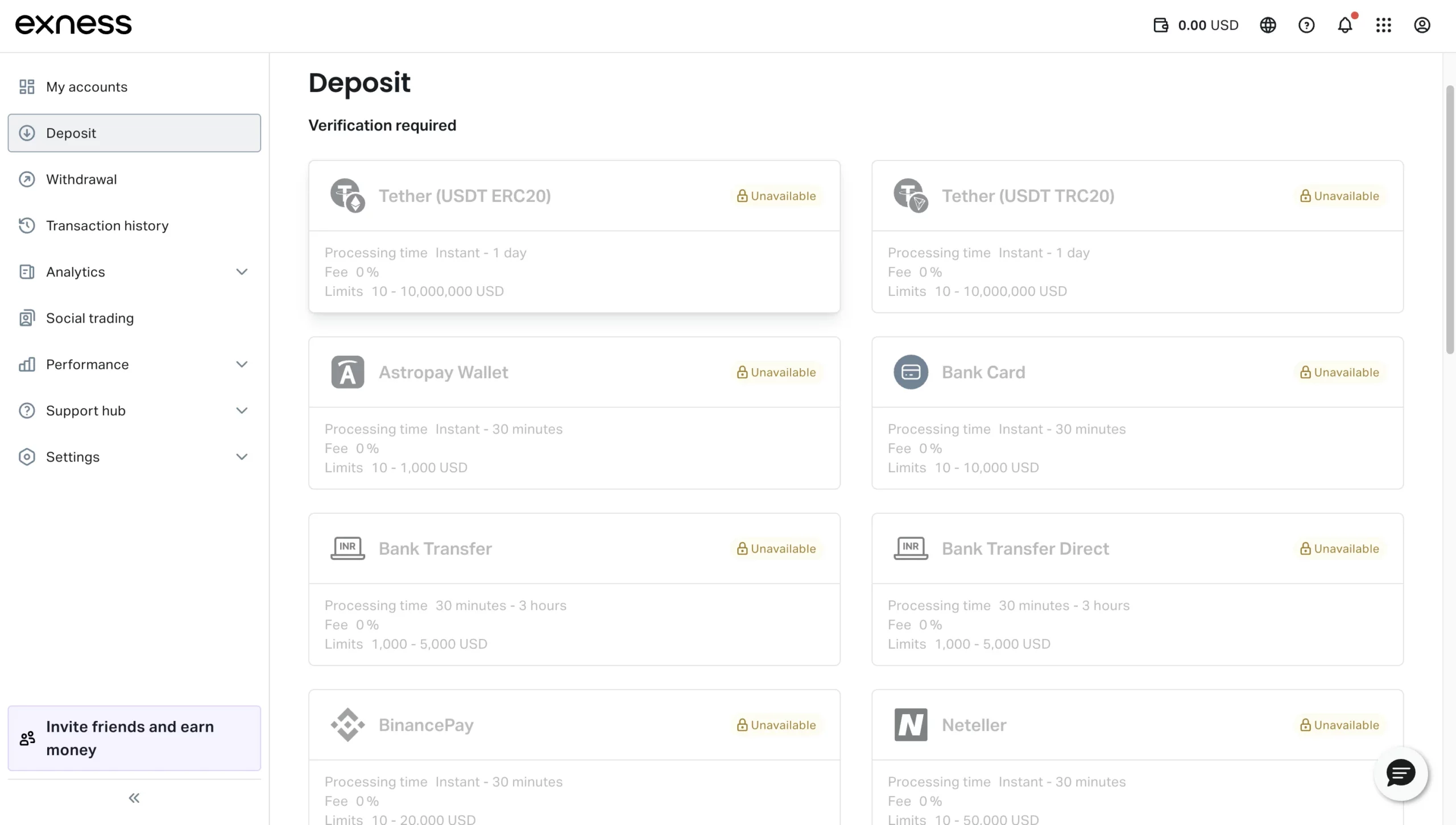

Exness Deposits and Withdrawals

Exness offers multiple deposit and withdrawal options for Qatari traders that simplifies the process of managing your trading funds. The process is fast and easy, whether you are depositing funds to trade or withdrawing profits.

Minimum Deposit Requirements

Exness also boasts of having minimum deposit requirements that are quite flexible whereby traders can begin with only $1 depending on the account type. The low-entry barrier makes this broker perfect for novice traders who seek to start with a smaller investment while still benefiting from the full suite of trading services. The minimum deposit on more advanced accounts may be larger, accompanied by improved trading conditions and features.

Popular Payment Methods in Qatar

Exness Qatar provides the following payment methods popular with traders:

- Local Bank Transfers : Suitable for those who would like to make a deposit using their local banking system.

- Cards: Fund your account or withdraw your winnings using all major cards such as Visa and MasterCard.

- E-wallet: Skrill, Neteller these are most used and offer instant transactions as well.

- This is done because

This is done because the payment methods selected are used so that your deposits and withdrawals can be made quickly, with easiest transactions completed immediately. For Qatari traders, this cuts the red tape and allows them to quickly deploy their trading capital.

Is Exness Legal in Qatar?

Yes, Exness is legal in Qatar. The broker operates under strict regulations from several reputable financial authorities around the world, ensuring that it adheres to international standards of transparency and security. While Exness is not directly regulated by a Qatari authority, its compliance with global regulatory bodies provides a level of security and legitimacy that is recognized internationally.

For traders in Exness Qatar, this means you can trade with Exness knowing that the broker follows strict rules designed to protect your funds and ensure fair trading practices. Additionally, Exness offers services that are aligned with local needs, such as Islamic (swap-free) accounts, which comply with Sharia law. This makes Exness a viable and legal option for traders in Qatar who are looking for a reliable and trustworthy broker.

Exness vs. Other Brokers in Qatar

When comparing Exness to other brokers available in Qatar, several factors set Exness apart. Exness has built a strong reputation for reliability, transparency, and customer-focused services, which are crucial for traders in Exness Qatar who seek a trustworthy platform. Let’s explore what makes Exness stand out in a competitive market.

Here’s a short comparison table highlighting key features of Exness versus two well-known brokers available in Qatar: XM and IC Markets.

| Feature | Exness | XM | IC Markets |

|---|---|---|---|

| Regulatory Bodies | FCA, CySEC, FSCA | CySEC, ASIC, DFSA | ASIC, CySEC, FSA |

| Minimum Deposit | $1 | $5 | $200 |

| Islamic (Swap-Free) Accounts | Yes | Yes | Yes |

| Spreads (EUR/USD) | From 0.3 pips | From 0.6 pips | From 0.1 pips |

| Execution Speed | <0.01 seconds | ~0.1 seconds | ~0.05 seconds |

| Instant Withdrawals | Yes | No | Yes |

| Customer Support Language | Arabic, English | Arabic, English, Others | English, Arabic, Others |

This table provides a quick comparison of Exness against XM and IC Markets, focusing on key features that matter to traders in Exness Qatar.

Why Qatari Traders Prefer Exness

Qatari traders often choose Exness because it’s a reliable and well-regulated broker. This means traders can feel confident that their money is safe and that they are dealing with a trustworthy company.

Exness also offers Islamic (swap-free) accounts, which is important for Muslim traders in Qatar. These accounts follow Sharia law, allowing traders to avoid interest charges on overnight positions.

Another reason traders prefer Exness is because of the low trading costs. The broker provides tight spreads and fast trade execution, which can help traders save money and act quickly in the market.

The ability to withdraw money instantly is another big plus. Exness allows traders to access their funds right away, which is very convenient and gives them control over their money.

Finally, Exness offers customer support in Arabic. This makes it easier for Qatari traders to get help when they need it, making their trading experience smoother and more comfortable.

FAQ

How do I download the Exness Qatar app?

To download the Exness Qatar app, go to the App Store (for iPhone) or Google Play Store (for Android). Search for “Exness,” then download and install the app. Once installed, you can log in with your account or create a new one to start trading.