What is the Exness Islamic Account?

Exness Islamic Account is a special type of accounts that are designed for Muslim traders, so they would be able to trade in the financial markets in accordance with their principles. Islamic finance revolves around the idea of Riba (interest), which makes every interest-bearing transaction not indulge in, including anything swap in trading which does not only overnight fees.

The Exness Islamic Account is swap free in nature, as the Islamic account is only designed to facilitate Shariah compliant trading, thus no interest or swap fees are levied on overnight positions. It allows Islamic traders to keep their trades long-term without them incurring interest, making it an option for those looking to participate in trading forex, metals, indices and cryptocurrencies whilst adhering to Islamic values.

The Exness Islamic Account provides access to the same Exness benefits as other accounts, including wide spreads, fast execution and access to Exness platforms like MetaTrader 4, MetaTrader 5 and the Exness Web Terminal while ensuring compliance with Islamic finance principles.

How to Open an Islamic Account on Exness

Opening an Islamic account on Exness is a straightforward process, allowing Muslim traders to enjoy swap-free trading that complies with Islamic financial principles. Here’s how to set it up:

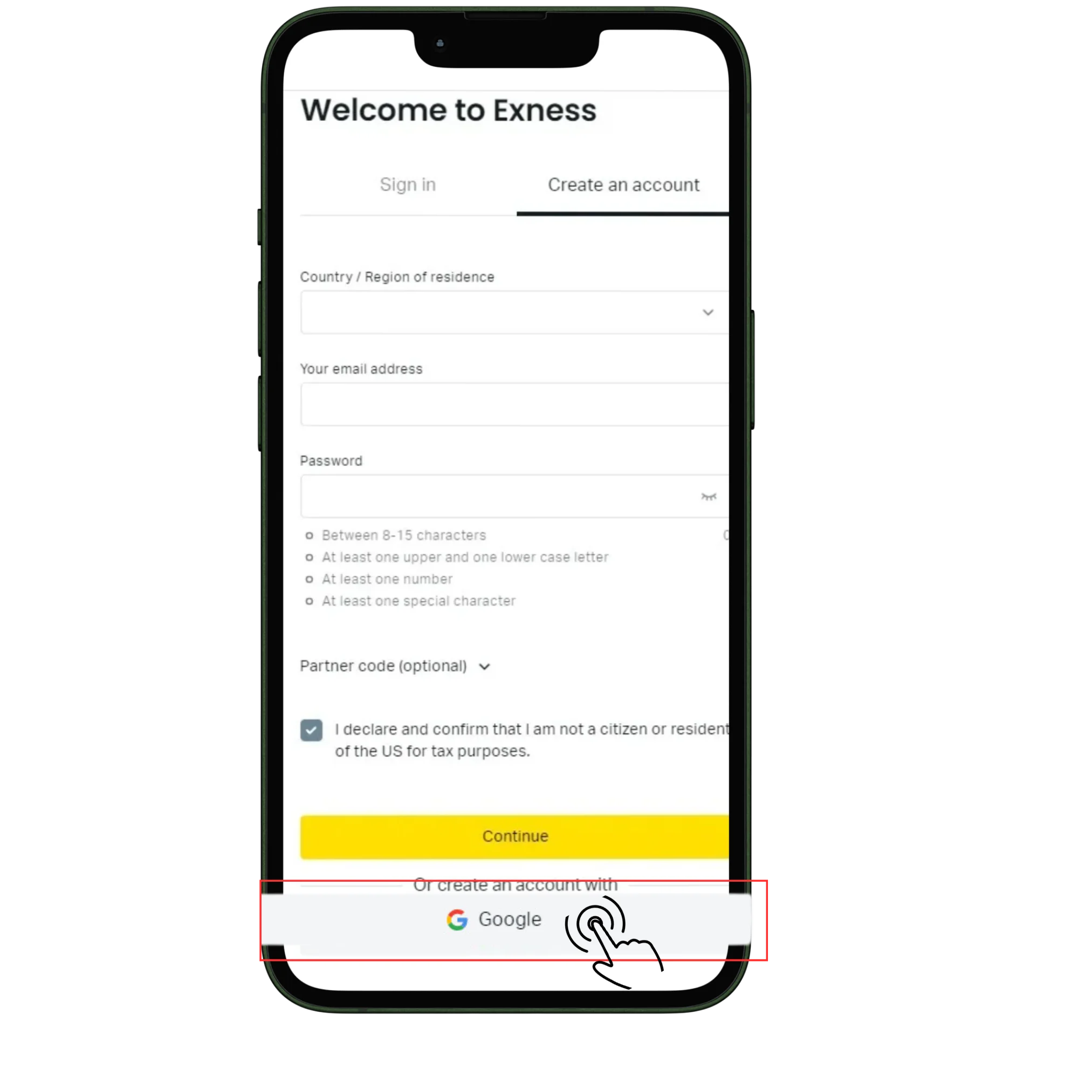

Step 1: Register for an Exness Account

- Visit the Exness Website or App: Go to the official Exness website or download the Exness mobile app (available on iOS and Android).

- Sign Up: Click on the Sign Up button to create a new account. You’ll need to enter some basic information, including your email, phone number, and personal details.

Step 2: Complete Exness Account Verification

- Identity Verification: Submit a valid government-issued ID (such as a passport or national ID) to verify your identity.

- Proof of Address: Provide a recent document (such as a utility bill or bank statement) that displays your address. Verification ensures your account is secure and enables full access to Exness features.

Step 3: Select Your Account Type and Enable the Islamic Option

- Choose Account Type: In your Exness Personal Area, select the type of account you wish to open. Most account types, such as Standard, Pro, and Raw Spread, offer the option to convert to an Islamic (swap-free) account.

- Enable Islamic Account: After selecting your Exness account type, look for the Islamic Account or Swap-Free option. Activating this will automatically configure your account as swap-free, meaning there will be no interest charges on overnight positions.

Step 4: Fund Your Account

- Deposit Funds: After setting up and verifying your account, fund it by using any one of Exness’s many funding options (bank transfer, credit card, e-wallets, etc.). The amount required to open an account will vary depending on the account you choose.

Step 5: Commence Shariah-Compliant Trading

- Simply Access Your Account: Log in to your chosen trading platform (MetaTrader 4, MetaTrader 5, the Exness Web Terminal or Exness mobile app) and you can start trading knowing your account is 100% free of anything that is not compliant with Islamic principles.

- No Swap Fees to Pay: Once activated Islamic Account means you will not pay overnight interest on positions, and be able to trade freely in a Shariah-Compliant manner.

Principles of Islamic Financing

It is a type of financial management, which has rules and guidelines from Shariʻa (Islamic law) which are set out to guarantee fairness, transparency and risk sharing in financial activities. These principles guide Islamic finance and are incorporated to maintain the transactions’ Islamic compliance. Here are the core principles:

- Prohibition of Riba (Interest): Islamic finance prohibits interest (Riba) in all forms. This makes Exness Islamic Account compatible for Muslim traders with fees of overnight interest (swap) fees being removed.

- Fair and Transparent Transactions: Islamic finance encourages fairness and transparency. Experience genuine pricing, with a regulated margin, due to Exness’s access to live market conditions and dedicated order routing.

- Principle of Risk-sharing: Islamic financial systems promote and support sharing of risk and responsibility. Islamic Account of trading allows the traders to involve themselves in permissible trading activities following an ethical and Shariah-compliant framework.

Exness Islamic Account Features

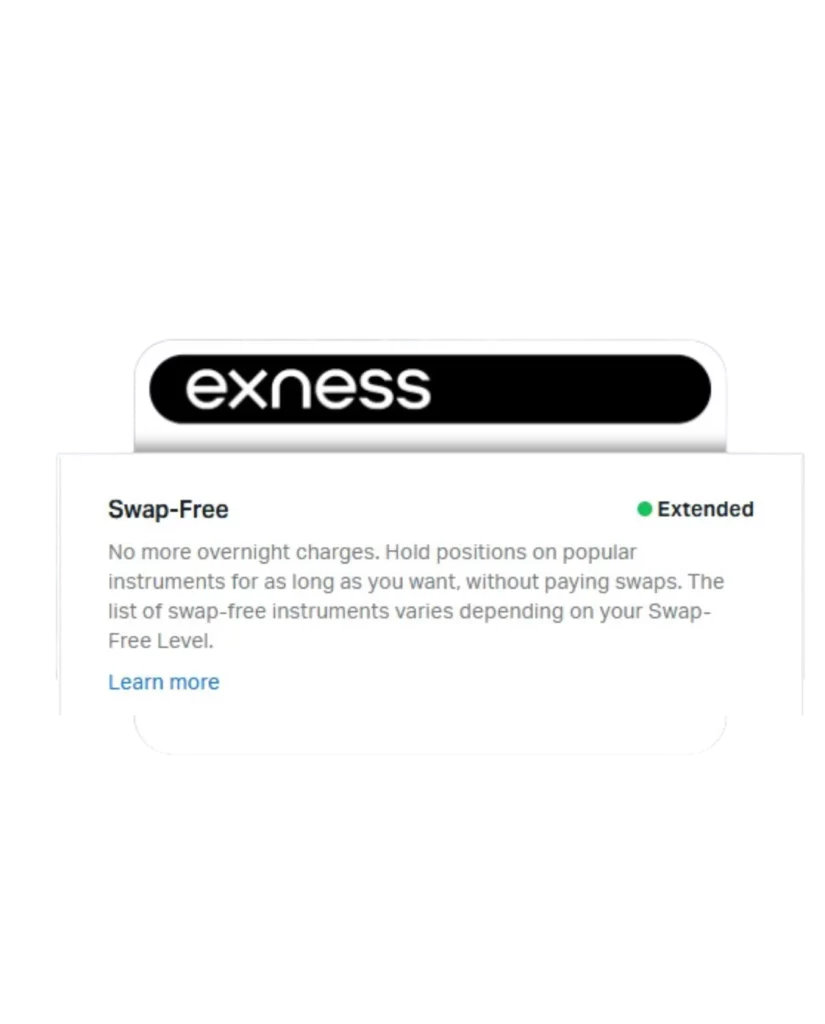

The Exness Islamic Account is designed to meet the needs of Muslim traders by providing a swap-free trading environment that aligns with Islamic finance principles. Here are the key features:

- No Swap Fees:

Positions held overnight do not incur any interest or swap charges, ensuring that trading complies with Shariah principles.

- Across Multiple Account Types:

The Islamic option is available on Standard, Pro, and other account types at Exness, meaning Muslim traders can select the account type that meets their preferences.

- Full Trading Tools Provided:

All trading tools, indicators, and features are provided on Exness platforms (MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness mobile app).

- Competitive Spreads and Execution:

Similar to non-Islamic accounts, Islamic accounts are provided with competitive spreads and swift execution, which guarantees traders high-quality trading conditions.

Comparison of Exness Islamic Account with Standard Accounts

Similar features are offered by both the Exness Islamic Account and Standard Accounts, including competitive spreads, access to a wide range of trading instruments, and full platform compatibility. But these accounts do have some notable differences, especially in terms of swap fees and adherence to Islamic finance principles. Here’s how the key features stack up:

| Feature | Exness Islamic Account | Exness Standard Account |

|---|---|---|

| Swap Fees | No swap fees (swap-free) | Swap fees apply on overnight positions |

| Shariah Compliance | Follows Islamic finance principles | Not specifically aligned with Shariah |

| Access to Instruments | Full access to all trading instruments | Full access to all trading instruments |

| Account Types | Available in Standard, Pro, Raw Spread, Zero | Available in Standard, Pro, Raw Spread, Zero |

| Cost and Spreads | Competitive spreads, no additional fees | Competitive spreads, swap fees apply on non-Islamic accounts |

| Long-Term Trading Suitability | Suitable for long-term strategies | More suitable for short-term or intraday trading due to swap fees |

| Platform Compatibility | MT4, MT5, Web Terminal, Mobile App | MT4, MT5, Web Terminal, Mobile App |

FAQ

What is the Exness Islamic Account?

The Exness Islamic Account is a swap-free account designed for Muslim traders, allowing them to trade without overnight interest charges, making it Shariah-compliant.